If you’re gearing up for the CFA® exam, you already know this isn’t your average multiple-choice test you can cram for the night before. The CFA Institute sets a high bar, and passing requires months of disciplined study, a clear strategy, and a whole lot of practice questions.

And with a $100k+ salary hanging in the balance, it’s worth the effort to ace those exams.

Whether you’re facing the CFA® Level I exam for the first time or wrestling with the final push toward Level III, the approach you take matters. Let’s walk through a game plan that can help you prepare for all three exams without losing your mind (or your social life entirely).

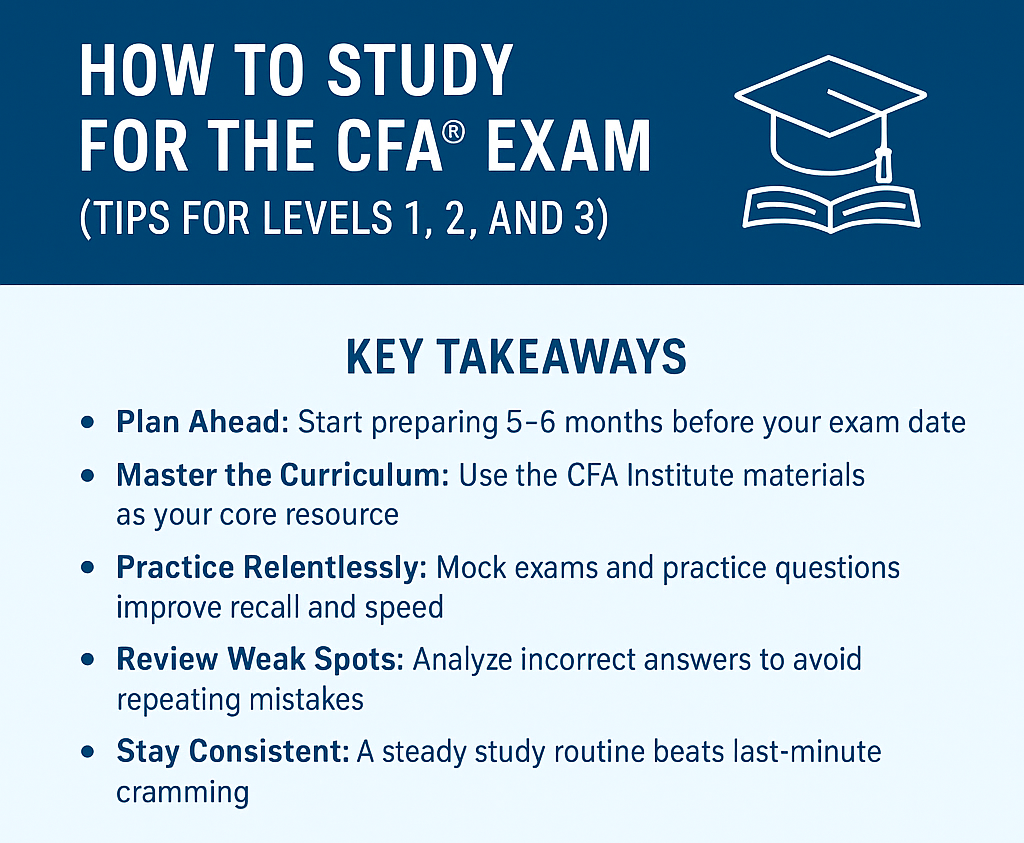

Key Takeaways

- Plan Ahead: Start preparing 5–6 months before your exam date.

- Master the Curriculum: Use the CFA Institute materials as your core resource.

- Practice Relentlessly: Mock exams and practice questions improve recall and speed.

- Review Weak Spots: Analyze incorrect answers to avoid repeating mistakes.

- Stay Consistent: A steady study routine beats last-minute cramming.

Understand the CFA® Exam Structure

Before you crack open a single book, you need to know what you’re up against. The CFA® program is made up of three exams:

- Level I: Heavy on basic investment concepts, financial statement analysis, and ethical and professional standards.

- Level II: More complex, focusing on application and in-depth analysis of the CFA® curriculum topics.

- Level III: Emphasizes portfolio management and integrating all the material you’ve learned.

Each CFA® exam level has its own exam question format and learning outcome statements, so your study plan needs to adjust accordingly.

Start Preparing Early (Seriously)

The CFA Institute suggests at least 300 hours of study per level. From experience and from talking with successful candidates, most people need every one of those hours, and sometimes even more.

Here’s a simple rule: start preparing at least 5–6 months before your exam date. That gives you enough time to:

- Learn the material in manageable chunks

- Take mock exams to test your knowledge under timed conditions

- Review incorrect answers to improve when you try again next time

The later you start, the more stressful it becomes—and the CFA® exam is stressful enough. I recommend using CFA® prep courses to help with your studying for Level 1, Level 2, and Level 3.

UWorld is one of the best, featuring up to five full-length mock exams per level, thousands of practice questions, live support (like Q&A-style office hours), and for some packages, access until you pass.

Build a Study Routine You Can Stick To

A solid study routine is one of the most underrated tools for CFA® exam success. You don’t have to study eight hours a day, but you do need consistency.

Tips for creating your study schedule:

- Block study time: Treat it like a work meeting you can’t cancel.

- Mix topics: Rotate between equity investments, corporate finance, technical analysis, and alternative investments so nothing goes stale.

- End with review: Spend the last 10–15 minutes of each session revisiting older material.

The CFA® exam isn’t just about knowing the concepts; it’s about being able to recall and apply them quickly.

Use the CFA® Curriculum as Your Core

It’s tempting to buy every shiny study guide and prep provider package you find online, but the official CFA® curriculum is your gold standard. It’s literally what the exam is built on.

Still, most candidates supplement with third-party resources to help break down complex topics, especially for areas like:

- Financial statement analysis

- Portfolio management

- Ethical and professional standards

The key? Balance. The CFA Institute materials tell you what you must know, and supplemental tools help you learn it more efficiently.

Practice Questions Are Your Best Friend

If you only remember one thing from this article, make it this: do as many practice questions as possible.

Why? Because the CFA® exam isn’t about memorization. You need to understand how concepts play out in real scenarios. Practice questions help you:

- Get familiar with the exam topics’ style and wording

- Spot patterns in wrong answers

- Improve your speed and accuracy under time pressure

Mix in short quizzes throughout your study routine and full-length mock exams as you get closer to exam day.

Make Mock Exams a Dress Rehearsal

Mock exams are a game-changer, especially for Levels II and III. They force you to manage your time, focus for long periods, and apply multiple concepts across topics.

Try to replicate exam day conditions as closely as possible:

- Same start time as your real exam date

- No distractions (yes, that means phone off)

- Only use the allowed materials

Afterward, spend as much time reviewing your incorrect answers as you did taking the exam. The review process is where you learn the most.

Adjust Your Strategy for Each Level

The three exams test different skill sets, so your approach should shift accordingly:

Level I:

- Focus on breadth — you need to know a little bit about a lot of topics.

- Spend extra time on ethical and professional standards since they’re heavily weighted.

Level II:

- Depth matters — you’ll need to apply concepts, not just recognize them.

- Case study-style questions mean you should practice interpreting data and performing financial analysis under time pressure.

Level III:

- Portfolio management dominates — understand evaluating portfolio performance in different scenarios.

- Practice essay-style questions; these can be tricky if you’re used to only multiple choice.

Track Your Progress and Adjust

Every few weeks, check how you’re doing:

- Which CFA® exam topics feel comfortable?

- Where are you consistently missing questions?

- Is your pace improving?

If you’re weak in certain areas, double down. It’s better to fix a knowledge gap early than hope it won’t show up on the exam. (Spoiler: it will.)

Don’t Neglect Ethics

Many candidates underestimate the ethics section, thinking it’s just “common sense.” It’s not. Ethical and professional standards are nuanced, and the CFA Institute often tests them in ways that catch people off guard.

The kicker? If your score is borderline, a strong ethics score can push you over the minimum passing score. That’s not a section you want to guess on.

Mind Your Well-Being

Studying for the CFA® charter is a marathon, not a sprint. Burnout is real, and it can tank your focus when you need it most.

- Take short breaks during study sessions.

- Keep exercising — it helps with concentration.

- Get sleep. Caffeine is not a substitute for rest.

The Week Before Exam Day

The final week isn’t for cramming all the material you’ve been avoiding. It’s for:

- Reviewing condensed notes and formulas

- Taking one or two final mock exams

- Making sure you understand your exam site logistics

This is also when you should complete your Professional Conduct Statement with the CFA Institute if you haven’t already.

Final Thoughts

Passing the CFA® exams takes serious commitment, but it’s doable if you plan your attack and stick to it. The combination of a realistic timeline, structured study routine, plenty of practice exams, and smart review habits can make the difference between a retake and a celebration.

Remember, the CFA® exam isn’t just testing what you know. It’s testing whether you can think like a professional in the investment industry. And that’s exactly why earning the CFA® charter carries so much weight in the finance world.

FAQs

Most candidates spend around 300 hours per level, spread over 5–6 months, to cover the material thoroughly.

Combine the CFA® curriculum with third-party resources, use a consistent schedule, and take plenty of timed mock exams.

There’s no age limit. Many professionals earn the CFA® charter mid-career to advance in the investment industry.

The CFA Institute doesn’t publish a set passing score, but historical data suggests it’s often around 60–70%.

It’s considered one of the toughest finance certifications, with pass rates typically under 50% for most levels.